IT'S HAPPENING AGAIN! |

A Merger Involving Two Pioneering Biotech Titans Just Happened & It Doesn't End There!

Dr. Phillip Frost & Dr. Steve Gillis

The Stock To Own In This Merger Is VBI Vaccines (NASDAQ: VBIV)

The deal involves two highly watched biotech legends that have created many blockbuster billion dollar deals for investors and IT JUST HAPPENED, but it will play out over the next few months!

Stock market history looks poised to repeat itself… at least, that’s what the facts could be implying now that VBI Vaccines (VBIV) and SciVac Therapeutics (SVACF) have decided to merge!

The question you should keep asking yourself, as we did... is "Why else would these two giants decide to join together other than to build a monster biotech company that could be worth billions some day?

Well the answer to that question becomes very apparent after you read the full story below...

In April ’15, savvy retail investors could have banked a hefty 240% winner after just 92 trading days by following the exploits of renowned billionaire biotech investor Dr. Phillip Frost.

The big return came after Dr. Frost hooked up with another famous billionaire biotech trailblazer named Ray Schinazi. Like Dr. Frost, Schinazi is a prolific biotech entrepreneur.

Over the years, Schinazi helped found five biotech companies, including Triangle Pharmaceuticals, which he sold to Gilead for $464 million; and Pharmasset, which Gilead acquired for $11 billion.

In November 2014, Dr. Frost’s biotech, Cocrystal (COCP), targeted Schinazi’s RFS Pharma for acquisition. Remember, after the merger, COCP’s shares soared 240% over a 3-4 month period... not in one day.

Frost's acquisitions seem to really begin to build momentum after the transaction and not the day of. So if you're looking for a quick day trade... stay away from this merger.

Ray Schinazi

It’s Once Again Time To Follow Dr. Frost’s Lead

Now, in a move ripped right from the pages of The Little Black Book of Billionaire Secrets… Dr. Frost is at it again, acquiring a company that’s led by one of the world’s foremost biotech pioneers.

Frost’s Israeli-based SciVac Therapeutics Inc. (SVACF) acquired VBI Vaccines Inc. (VBIV) in an unprecedented move that is about to take the biotech sector by storm and history could repeat itself yet again once the details of the transaction unravel!

The deal merges two potentially multi-billion dollar drug pipelines into one publicly traded company that you can get exposure to now by buying VBI Vaccines Inc (NASDAQ: VBIV). After closing of the merger, SciVac will change its name to VBI Vaccines Inc.

Of equal significance to investors is the other biotech legend involved in the deal.

Dr. Phillip Frost, US Forbes Rank: #112

Both SciVac and VBI Have Outstanding Pedigrees

Of course, SciVac’s majority shareholder, at 25% (14% post-merger, but still the largest single shareholder), is OPKO Health Inc. (NYSE: OPK), a $5 billion bio-pharmaceutical and diagnostics company which Dr. Frost founded.

As noted, Dr. Frost is also a serial builder of companies. Among his largest successes is IVAX, which Teva Pharmaceutical (NYSE: TEVA) acquired for $7.6 billion in 2005.

Frost then served as Teva’s Chairman until stepping down earlier this year to completely focus on Opko. Its shares have soared 350% under Frost’s leadership.

Dr. Frost is so respected on Wall Street that he once was named Governor and Vice Chairman of The American Stock Exchange.

The Legendary Dr. Steve Gillis

The SciVac/VBI merger offers investors a monumental opportunity to participate early on in another Frost merger that could become legendary!

That’s because a Seattle-based venture capital firm, Arch Venture Partners, owns 17% of VBI Vaccines. In all, Arch has $2 billion invested in biotech ventures.

In biotech circles, investors begin to drool at the mere mention that Arch Ventures could be part of a publicly traded deal because its managing directors are some of biotech’s earliest pioneers.

Among them is Dr. Steve Gillis, a man some consider one of the biotech industry fathers.

Dr. Steve Gillis

Celebrated $16 Billion Acquisition

Thirty-five years ago Dr. Gillis started a company called Immunex.

Along with co-founder Christopher Henney they recruited top scientific talent from around the world to Seattle. In the process they virtually invented the biotech industry.

Amgen acquired Immunex in 2002 for $16 billion.

Along with his position at Arch, today Dr. Gillis sits on the board of Shire plc (SHPG), the London-listed drugmaker which has a $40 billion market cap. He is also a board member of one of biotech’s hottest young companies, Bluebird Bio Inc., (BLUE), which has a $3 billion market cap with shares that ran from $30 - $197 last year.

That should be a reminder to you of the sudden and explosive returns the biotech sector can deliver to aggressive investors… investors who understand how a single moment can define a biotech company.

When The “Moment” Arrives, Biotech Shares Can Soar

- It may have had only 20 full-time employees, but Advaxis jumped 600%, from $4 last November to $28 in June 2015 after it announced two new drug applications and two very promising sets of trials.

- Then there was Recro Pharma. With only five full-time employees, it soared from $3.30 at the beginning of March 2015 to $14 by mid-April on news that it was buying the rights from Alkermes to a drug that was ready to go into Phase III trials.

When The “Moment” Arrives, Biotech Shares Can Soar

- Big-Time Biotech Success Is All About Being The First Into “Baby Blue-Chips” Such As These:

- Bluebird Bio (BLUE) – when its shares rose from $30 in October 2014 to more than $174 this June, BLUE’s investors netted a 480% gain in just 8 months.

- Radius Health (RDUS) – listed at $8 in June 2014, its shares jumped to $65 in June 2015. Its new drug let RDUS investors score a 713% gain in one year.

- Receptos (RCPT) – (Arch was an investor) its shares were at $26 in May 2014. Positive drugs trials, on multiple drugs, pushed shares to $189 in June 2015, rewarding investors with a 627% return in 13 months. Celegene bought RCPT for $231 a share in August 2015.

This list could go on and on…

- OPKO Health (OPK) – was formed by a reverse merger in February 2007 and opened at $1.98 a share. OPKO is now at $9.40 a 374% gain.

- Retrophin (RTRX) came to market on Dec. 12, 2012 at $5.15. The stock is now at $17.31, a 236% gain.

- Assembly Biosciences (ASMB) announced its reverse merger on July 11, 2014 at $7.25. In less than a year they soared to $19.01.

- Tobira (TBRA) came to the market on May 4, 2015, opening at $10.89. Five weeks later, shares were up 106%

- Finally, there is Cubist. It’s the Mac Daddy of recent biotech winners and 2014’s biggest biotech surprise. In December, Merck bought Cubist for $9.5 billion. Merck’s final price of $102 a share was a 2,239% gain from the stock’s Oct. 2002 low.

As We Close Out 2015, Making A Move Now Into VBI Vaccines Inc (NASDAQ: VBIV) Gives You A Solid Position To Make A Potentially Monumental Gain On What Could Be One Of 2016’s Biggest Biotech Winners

When you get down to the nuts and bolts of this merger, the fact that it was completed by legendary investors becomes incredibly apparent.

When you get down to the nuts and bolts of this merger, the fact that it was completed by legendary investors becomes incredibly apparent.

Particularly when you hold on to this one vital thought…

Great biotech companies are built on the strength of their drug pipelines and great people… a combination of market-ready therapies mixed with some farther out, but potentially breakthrough drugs.

That’s why this merger makes perfect sense.

In a nutshell, it’s about a company, SciVac, with a drug that could dominate a $1 billion global market merging with a company, VBI, with some potentially earthshaking therapies deep in its pipeline.

SciVac’s Flagship Vaccine Has

Already Treated 500,000 People

First, let’s look at SciVac’s flagship product, Sci-B-Vac, which is a third-generation hepatitis B vaccine.

First, let’s look at SciVac’s flagship product, Sci-B-Vac, which is a third-generation hepatitis B vaccine.

The breakthrough vaccine is already approved in 10 countries. It has safely and effectively treated more than 500,000 patients.

But that is a tiny number compared to the potential market, but don’t lose sight of them… those half million healthy patients could be the key to SciVac’s “moment.”

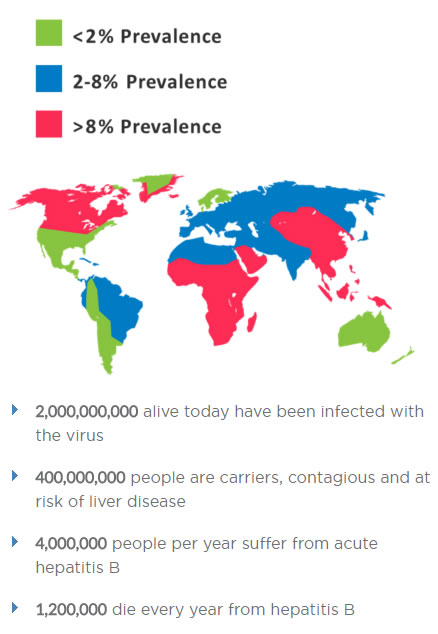

That’s because hepatitis B is a global health problem with significant unmet medical needs… the numbers are staggering.

Hepatitis B kills 1.2 million people every year. It is 100 times more infectious than HIV. Over a billion vaccines have been administered since 1982… but the crisis keeps expanding.

Two billion people alive today have been exposed to the hepatitis B virus… four million people become acutely sick with it each year.

But now there could be true hope of eradicating this virus because Sci-B-Vac is the only commercial hepatitis B vaccine to mimic all 3 of the killer virus’ surface antigens.

That means SciVac’s vaccine achieves a rapid onset of protection, high levels of anti-hepatitis B antibodies at lower dosage than competing vaccines.

This is why Sci-B-Vac has the potential to create a $2.5 billion hepatitis B therapeutic market.

Getting On The Fast-Track

Could Make SVACF Worth A Fortune

Of course, widespread vaccinations depend on the approval European and American regulators.

But, remember, SciVac’s breakthrough vaccine is already approved in 10 countries. It has safely and effectively treated more than 500,000 patients.

Remembering what you saw on the list above, you’ll see that chances are, SciVac’s major investable “moment” will come months before the trials begin…

So, when it comes to SciVac, in its pre-merger form – the near term – investors should focus on the fact that its pipeline has a hepatitis B vaccine that could come rushing onto the scene in less than two years.

The Sci-B-Vac could create a market as large as $2.5 billion.

Add Another Famous Who’s-Who

Of Biotech Into This Mergers Winning Mix

As exciting as SciVac’s near-term is, its long-term prospects could see it becoming a major biotech thanks to its VBI Vaccines acquisition.

As exciting as SciVac’s near-term is, its long-term prospects could see it becoming a major biotech thanks to its VBI Vaccines acquisition.

That’s because VBI’s President and CEO could be on track to join Dr. Gillis as a biotech sector legend.

VBI’s CEO is Jeff Baxter. Prior to joining VBI, Mr. Baxter was senior vice president of R&D, Finance and Operations, for the global life science behemoth GlaxoSmithKline (GSK). In that job he was responsible for pipeline resource planning and allocation, business development deal structuring and SROne, which is GSK’s in-house $125m venture capital fund. He also chaired GSK’s Research and Development Operating Board.

Under his leadership VBI’s pipeline is full of cutting-edge potential.

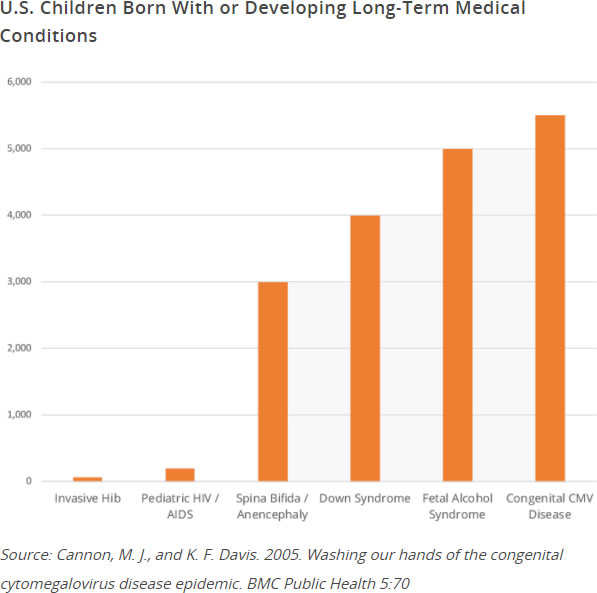

It has a cytomegalovirus (CMV) vaccine candidate. That is a fertile market that could exceed $1B annually.

CMV is one of the world’s most common viruses. Its direct economic cost in the U.S. exceeds $2.0 billion annually.

CMV affects more live births than Down Syndrome or Fetal Alcohol Syndrome, making it a key public health priority and a strong candidate for recommended universal vaccination among certain high-risk populations.

VBI Is Also Way Out On The Cutting Edge

Breaking Down Technological Barriers

VBI is working on a technology it calls Liquid Particle Vaccines (“LPV”).

It about taking current vaccines and biologics and making them so they can withstand elevated and fluctuating temperatures.

That is a huge deal, because more than 90% of all vaccines require stringent “cold chain” shipment.

Think about getting a flu shot at your local pharmacy. The vaccine comes out of a refrigerator.

This is because unless it remains at a constant temperature, in a very narrow range above freezing, the flu vaccine would lose its potency and become ineffective, or can become hazardous. Most vaccines need the same diligent attention to temperature.

Vaccine Makers Could Flock To LVP Technology

![]() In addition, reliance on a cold chain increases vaccine costs by up to 20% and is a significant barrier to patient access in many emerging markets.

In addition, reliance on a cold chain increases vaccine costs by up to 20% and is a significant barrier to patient access in many emerging markets.

The global vaccine market is now $24 billion a year… under the right circumstances, like with stable vaccines, it could grow to $100B by 2025.

Imagine how large the market could be for VBI’s LPV technology when global vaccine makers realize that with a slight reformulation, their vaccines could be made to withstand harsh global conditions.

Thermostable-vaccine delivery could open the world’s emerging markets, places from which some of the world’s worst viruses, such as Ebola, emanate.

There Could Never Be A Better Time Than Today

To Make A Move Into VBI Vaccines (VBIV)…

Its Potential Is Off The Charts!

Ultimately, the SciVac/VBI merger could create a monster biotech company that Frost and Gillis intend to build.

Why else would they be teaming up?

Such a success would be built on SciVac’s (Soon-to-be VBI Vaccines) full pipeline and by its farsighted leadership, such as that offered by Dr. Frost and Dr. Gillis.

After all, as you’ve seen, success usually follows Dr. Frost as he builds these companies out over time.

Just as it did with when he sold IVAX to Teva for $7.6 billion. And, just as it did when investors could have claimed a 240% gain after Frost’s Cocrystal Phrama Inc. acquired RTS Pharma, a merger that took place almost exactly one year ago.

Biotech explosions like those are why investors should always consider that a portion of winning portfolios should be dedicated to emerging biotech companies… particularly biotech’s run by Dr. Phillip Frost and Dr. Steve Gillis.

VBI Vaccines Inc (NASDAQ: VBIV)

INVESTORS SHOULD READ THIS DISCLAIMER

Who owns and controls the website located at http://BiotechStocks.com

The website located at http//www.BiotechStocks.com (the Website) is owned by MAPH Enterprises, LLC., a Florida corporation. The Website, its owner, affiliates, control persons, directors, officers, employees and agents are hereafter collectively referred to as the “Publisher”, “we”, “us” or “ours”.

What do we do?

We are paid advertisers, also known as stock touts or stock promoters who disseminate favorable information (the “Information”) about publicly traded companies (the “Profiled Issuers”).

How is the Information published?

We publish the Information on the Website, in newsletters, audio, and live interviews featured reports message boards and email communications for specific time periods that are agreed upon between us and the Profiled Issuer. Our publication of the Information is known as a “Campaign”.

Will everyone receive the Information at the same time?

No. The Information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart.

How is a potential investor impacted if they receive the Information later than other investors?

If the trading volume and price of a Profile Issuer’s securities increases after the Information is provided to an earlier group of investors, then subsequent investors will pay inflated prices for any securities of the Profiled Issuers that they purchase. This will likely result in the Profiled Issuers having trading losses.

What will happen when the Campaign ends?

Most, if not, all of the Profiled Issuers are penny stocks that are illiquid and whose securities are subject to wide variations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will likely lose most, if not, all of their investment.

Why do we publish only favorable Information?

We only publish favorable information because we are compensated to only publish favorable information.

Why don’t we publish negative information?

We don’t publish negative information because we are not paid to publish negative information. We are paid to publish only favorable information.

Is the Information complete, accurate, truthful or reliable?

The Information is a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one sided and not balanced, complete, accurate, truthful or reliable.

What we do not do.

We do not publish negative information about the Profiled Issuers. We do not verify or confirm any portion of the Information. We do not conduct any due diligence or research any aspect of the Information including the completeness, accuracy, truthfulness or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

Where does the Information come from?

The Information is provided to us by the Profiled Issuers and/or the person who hires us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, the Securities and Exchange Commission’s Edgar database or other available public sources.

What will happen if an investor relies on the Information?

The Information is neither a solicitation to buy nor an offer to sell securities. The Information should not be used to make an investment decision or for trading or investment purposes. If an investor relies on the Information in making an investment decision it is highly probable that the investor will lose most, if not, all of his or her investment.

Who pays us to publish the Information?

The source of our compensation varies depending upon the particular circumstances of the Campaign. We are compensated by the Profiled Issuers, third party shareholders and other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

The nature and amount of compensation we receive for publishing the Information about each Profiled Issuer and our ownership of each Profiled Issuer is set forth below under the heading captioned, “What we are compensated”.

What warranties do we make about the Information?

None. We make no warranty or representation about the Information including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and impliedly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

Who is responsible if an investor relies on the Information?

The investor. We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information. A person’s review and/or reliance upon the Information is at their own risk. We are not responsible for omissions or errors in the Information. We will not update the Information and we are not responsible for actions taken by any person who relies upon the Information.

What do we urge potential investors to do?

Investors should conduct their own in-depth investigation of the Profiled Issuers with the assistance of his or her legal, tax and investment advisors. An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information you and your advisors deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information you receive directly from the Profiled Issuers or from websites such as Google, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

Why is this Disclaimer being provided?

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 ( the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (“the “Securities Act”), to specifically disclose our compensation to you as well as other information including that we may hold, as well as purchase and sell the securities of a Profiled Issuer before, during and after we publish the Information about the Profiled Issuer. We may instruct investors to purchase the securities of a Profiled Issuer during the same time that we sell.

The anti-fraud provisions of state and federal securities laws require us to inform you that we will engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

What we are not.

We are not and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following:

- An independent advisor or consultant;

- Providing investment advice;

- Acting in the capacity of an investment adviser or engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal or state level;

- Broker-dealer activities or acting in the capacity of a registered representative or broker;

- Stock picker;

- Securities trading expert;

- Securities researcher or analyst;

- Financial planner or financial planning;

- Provider of stock recommendations;

- Provider of advice about buy and sell or hold recommendations as to specific securities; or

- Making an offer or sale of securities or solicitation to purchase securities.

What conflicts of interest do we have in publishing the Information?

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the following:

- We receive monetary and/or securities compensation in exchange for publishing the (favorable) Information about the Profiled Issuers;

- We do not publish any negative information whatsoever about the Profiled Issuers;

- We may own a Profiled Issuer’s securities that we acquired from the Profiled Issuer, third parties or from our own open market purchases before, during or after the Campaign and we may sell these securities during the Campaign while publishing the (favorable) information that instructs investors to purchase. Our selling of a Profiled Issuer’s securities will likely cause investors to suffer losses;

- A short time after we acquire a Profiled Issuer’s securities, we may publish the (favorable) Information about the Profiled Issuer advising others, including you, to purchase; and while doing so, we may sell the Profiled Issuer’s securities we acquired during our public dissemination of the Information causing us to profit while you suffer a loss;

- Parties holding a Profiled Issuer’s securities including those who engage our services and/or compensate us will sell their shares of the Profiled Issuer while we are publishing the (favorable) Information.

What are some of the risks that investors should be aware of?

Any investment in the Profiled Issuers involves a high degree of risk and uncertainties and may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers includes, but is not limited to the risks stated below.

- The Information is not a solicitation or recommendation to buy, sell or hold securities and we do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

- If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

- The Information may contain statements that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

- The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

- You may encounter difficulties determining what, if any, portions of the Information is material or non-material making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

- When the Campaign ends, the securities of a Profiled Issuer will decline dramatically.

- If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates as such, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative ; (b) consumers, producers, investors, borrowers, lenders and government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in such economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of fully new circumstances and situations in which uncertainty becomes reality rather than of predictive economic quality; or (f) if the trends involve a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

- The Information contains forward looking statements, i.e. statements or discussions that constitute predictions, expectations, beliefs, plans, estimates, or projections as indicated by such words as expects, will, anticipates, and estimates; therefore, you should proceed with extreme caution in relying upon such statements and conduct a full investigation of the Information and the Profiled Issuer as well as any such forward looking statements. Any forward looking statements we make in the Information are limited to the time period in which they are made and we do not undertake to update forward looking statements that may change at any time.

- The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities and to consult your financial, legal or other advisor(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic medium, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the Pink Sheets or otcmarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative signs at otcmarkets.com (See section below titled Risks Related to the Profiled Issuers, which provides additional information pertaining thereto).

- We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer even where such compensation is not disclosed by them.

- By reading the Information you agree to indemnify and hold us harmless from any liability for any claimed direct, indirect, incidental, punitive, or consequential damages pertaining to your receipt of the Information.

Risks Related to the Profiled Issuers

- We do not provide you with all of the risks related to the Profiled Issuers and to understand such risks you must conduct your own due diligence with the assistance of your legal, tax and investment advisor.

- Any investment in a Profiled Issuer’s securities is high risk. If you invest in the securities of a Profiled Issuer you could lose your entire investment.

- The continued operations and future prospects of a Profiled Issuer may be dependent upon receiving adequate financing which they may be unable to obtain.

- If a Profiled Issuer is an SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports) or OTC Market’s Pink Sheet quoted company may be delinquent in its Pink Sheet reporting obligations as reported by the OTC Markets News Service’s or OTC Markets posting a negative sign pertaining to the Profiled Issuer at www.pinksheets.com, as follows: (i) Limited Information for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) Pink Sheets – No Information, which indicates companies that are unable or unwilling to provide disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) Caveat Emptor, signifying Buyer Beware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

- Often the Profiled Issuers are development stage companies with little or no operations, and their securities should be considered extremely speculative for investment purposes.

- The Profiled Issuers are negatively affected by the current economic downturn and may have a lack of adequate financing to meet their operating expenses, operational goals and expansion plans.

- The Profiled Issuers may have inadequate financing to pursue their operational plans and support their ongoing operations.

Risks Related to buying the securities of the Profiled Issuers

- The Information may recommend that investors purchase a Profiled Issuer’s shares while we sell securities of the same Profiled Issuer which will likely cause investors to suffer losses.

- We may receive free trading shares as compensation or we may acquire such shares in open market transactions before and during the Campaigns, and we may sell the shares we acquire at any time, even during the Campaigns while publishing the Favorable Information. When we sell the shares of the Profiled Issuers that we hold, the price at which investors can sell their shares will dramatically decrease and will likely cause investors to suffer trading losses.

- We may sell securities of the Profiled Issuers for less than target prices set forth in the Information, and we may profit by selling our securities during the Campaigns while investors encounter losses.

- The Information may instruct investors to buy a Profiled Issuer’s securities so that the person who hires and compensates us can sell their own shares which may cause you to suffer a loss of part or all of your investment.

- When we acquire, purchase or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit us to make substantial profits while investors who purchase during the Campaign experience significant losses.

- The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

- If we are compensated in improperly free trading securities of the Profiled Issuers, either directly or indirectly from persons who claim to be non-affiliates of such Profiled Issuer, we and the Profiled Issuer or third party could be subject to SEC Enforcement action, including allegations of an illegal distribution in violation of Section 5(a) and 5(c) of the Securities Act.

Are risks in this disclaimer the only risks investors should be aware of?

No. There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax adviser prior to purchasing the securities of any Profiled Issuer.

What we were paid.

MAPH Enterprises LLC BiotechStocks.com | was paid an advertising fee of $30,000 cash & ZERO shares by a non affiliate 3rd party share holder. for visual sponsorship on BiotechStocks.com and for visual placement of VBIV. within written materials. FOR A DURATION OF 30 DAYS BEGINNING 11/30/2015 - 1/1/2016